Where Serious Deals Separate Themselves

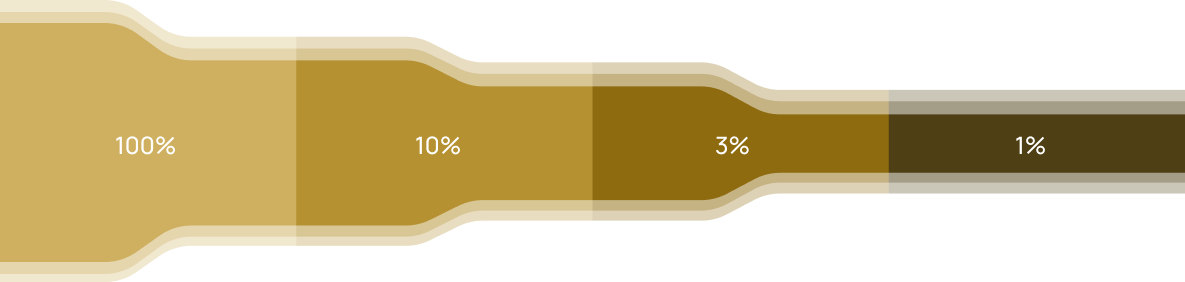

Inbound Requests

1,000+ proprietary & inbound deals screened at source

AI Enabled Deal Filtering & Screening

90% of opportunities are eliminated through AI-driven evaluation based on promoter quality, sector fit, scalability, and core business fundamentals

In-Depth Due Diligence

Shortlisted deals undergo 40-parameter due diligence across all critical business dimensions to ensure institutional readiness.

Investor Match & Circulation

Only select deals with strong fundamentals, high growth potential, and execution credibility are presented to PrEqt’s curated investor network.

Ambitous Founders. Patient Investors.

Institution Grade Execution

Ambitous Founders. Patient Investors.

Institution Grade Execution

PrEqt is Built on 3 Core Pillars.

Ambitious Companies. Patient Investors. Institution Grade Execution.

We work only with businesses built for public markets—not experiments.

- Strong corporate governance & promoter integrity

- Professional management and decision discipline

- Scalable, high-growth industry positioning

- Clean financials with audit readiness

- Compliance-first mindset

Access to institutional-grade, patient capital—not deal chasers

- 15,000+ UHNIs & Family Offices

- Angel, Pre-IPO, AIF & strategic investors

- Long-term, thesis-driven investing

- Deep experience across SME & Main-Board IPOs

SEBI-registered, end-to-end execution

- SEBI-registered merchant bankers

- Capital structuring: Equity, CCPS, OCDs

- DRHP / RHP drafting & regulatory filings

- Anchor strategy, listing & post-listing support

- Fully compliance-driven workflows

Where Companies, Capital, and Execution Converge

- PrEqt sits at the intersection of credible companies, serious capital, and institution-grade execution—creating a seamless pathway from private growth to public markets.

We don’t just enable fundraising.

We simplify investment banking.

PrEqt is Built on 3 Core Pillars.

Ambitious Companies. Patient Investors. Institution Grade Execution.

Companies

(Public-Market Ready)

Execution & Compliance

(Institution-Grade Delivery)

Conviction Capital

(Serious Investors Only)

Problems with the traditional way

PrEqt replaces chaos with clarity

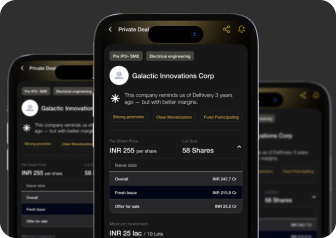

Unclear/Vague Fundraising Pathway

Deviated Offers

Valuation Opaqueness

Deals Buried in Whatsapp Forwards

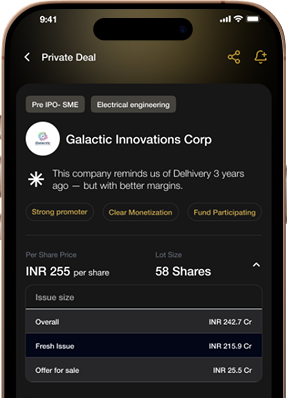

100+ Interested Investors | 10+ NDAs Signed | 4 Final Offers (for promoters)

Strategic Investors spend 75% less time!

Standardized Investor Deal Tiles

03

How will it Benefit Investors?

A controlled, insight-driven investment environment that gives investors early access to quality deals, direct promoter interaction, and AI-backed analysis—reducing information asymmetry and decision risk in pre-IPO investing.

1

Access to Exclusive Deal Rooms

Curated, invite-only access to live pre-IPO opportunities.

Ensures deal quality and eliminates noise from unverified listings.

2

Direct Communication with KMPs

Structured interaction with promoters and key management.

Improves transparency and enables informed conviction building.

3

AI-Enabled Deal Assistant

AI-powered analysis of financials, risks, and key deal metrics.

Helps investors evaluate opportunities faster and more objectively.

4

Pre-Verified Deals

Deals screened for regulatory, financial, and governance readiness.

Reduces due-diligence overhead and execution risk.

How this will Benefit

Promoters

Designed to help promoters achieve faster listings, stronger valuations, regulatory confidence, and long-term market credibility—without the inefficiencies of a traditional IPO process.

Access To Strong Investor Base

Access to institutional investors, HNIs, and family offices active in IPO markets. Drives faster fundraise and stronger listing demand.

IPO Readiness Report / Eligibility Checker

SEBI-aligned readiness and eligibility assessment. Clear gaps and action plan for IPO execution.

IRPR, Drafting & Regulatory, Post-Listing Liquidity, Pricing & Distribution

End-to-end IRPR, drafting, and regulatory support. Post-listing pricing, liquidity, and distribution management.

Bridge Gap from Private to Public Markets

Aligns promoters, structure, and disclosures for public markets. Ensures smooth transition to listed status.

50% Faster IPO Turnaround Time

Parallel workflows eliminate delays. Cuts IPO timelines by up to 50%.

Connect with a Network of Trusted Investors

Join our community to access verified investors, funding opportunities, and peer insights.